National Payments Corporation of India (NPCI) is engaged on a digital funds product for feature cellphone customers and those that usually are not too comfortable using mobile apps. The product is on the proof of concept (POC) stage right now, Praveena Rai, chief operating officer, NPCI mentioned.

The brand new product shall assist further the NPCI’s purpose of taking digital payments to each Indian, she mentioned. “We need to move into the market which is feature phone-based…Moving towards voice-enabled payments will be the trend of digital payments that we should see and India will be a clear innovator there,” Rai added.

In 2020, NPCI, CIIE.CO and the Bill and Melinda Gates Foundation had together launched a hackathon for the creation of a feature phone-based payments solution. The brand new product, set to be launched within the coming months, is an outcome of that hackathon, where fintechs Gupshup, Minkville and Tonetag have been adjudged the top contestants.

Whereas an SMS-based payment solution known as Unstructured Supplementary Service Data (USSD) was launched by NPCI in 2016, its use later bought discontinued with the launch of the Bharat Interface for Funds (BHIM) app in late 2017.

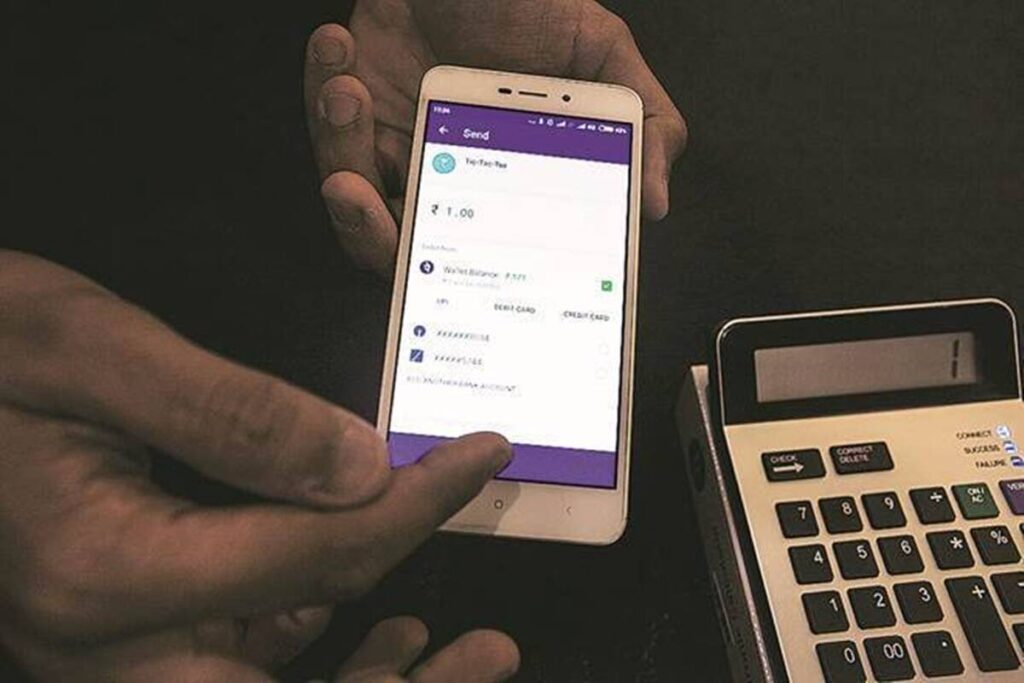

NPCI, which has generally been criticised for not looking beyond its flagship product Unified Payments Interface (UPI), can be operating one other hackathon on payment authentication, which was launched last month. Rai mentioned that this specific competitors is aimed toward in search of better methods of authenticating UPI transactions whereas making the safety methods stronger than they presently are. The options needs to be UPI-integrated which might showcase end-to-end on-boarding of customers and authorisation of transactions, together with offering parameters to allow danger scoring of customers and transactions.

The organisation continues to discover the opportunity of making the country’s transit systems digitally enabled. The Delhi Metro’s Airport line has a QR code-based ticketing system. The solution is now being prolonged to bus services, with Canara Bank already operating the project in Bengaluru. NPCI plans to make this a pan-India solution.